Which bureau’s credit score matters the most?

Different bureaus, different credit scores. Which one is the best? Read on to understand how this works.

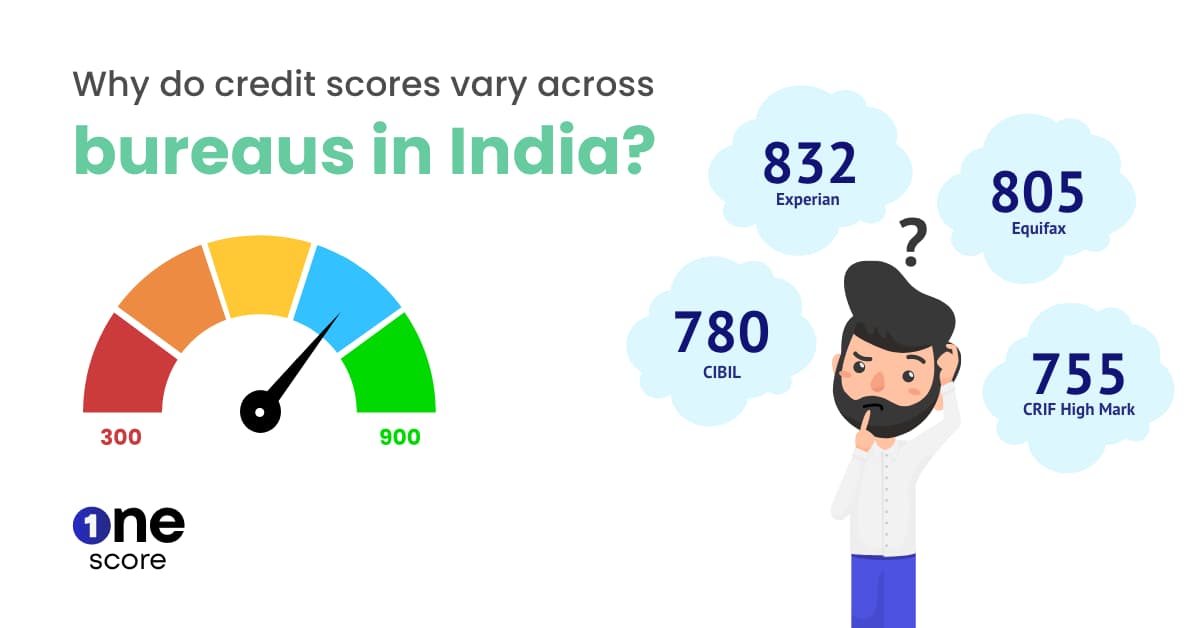

While checking your credit score on various websites, you may have noticed that they may differ from one another. This can be confusing and at times even leave you wondering which Credit Score is the one you should follow. Read on to understand more!

The difference in scores is mostly because there are 4 RBI-licensed credit bureaus in our country who calculate credit scores, namely, CIBIL TransUnion, CRIF High Mark, Equifax and Experian. Each bureau has its own proprietary algorithm and model through which they deduce a person’s credit score. Since the models they operate on are different from one another, so are the credit scores generated by each. Depending on who the platform you are on has tied up with, your score could be different.

However, of the four bureaus, there’s no such thing as the ‘more accurate or important” credit score. All these credit scores represent the same thing - your creditworthiness to lenders. So as long as you display good credit behaviour (Read: What factors affect your credit score), you are most likely to have a favourable credit score across all bureaus, barring minor differences.

Couple of other reasons that cause a difference in scores across bureaus.

1: Difference in reporting schedule

Credit bureaus get their information from banks and other financial institutions. Different lenders have different reporting schedules for sharing the information with the bureaus.

At any given point, it’s highly likely that one bureau has more updated information or data points than the other, which leads to a difference in credit scores.

2: Inconsistencies in reporting

Sometimes, it may happen that information or data points provided to the bureau is incorrect or wrongly captured. This can lead to a significant rise or drop in the credit scores. If that’s the case, you should immediately bring these discrepancies to the concerned bureau’s notice.

The Good News!

You can check your CIBIL and Experian credit score on the OneScore app as often as you like, for free. That’s not all! This app also gives you detailed personalised insights about your payment history since the time you first took a credit product, however long ago that may have been. If you notice any error or incorrect entry in your report, you can immediately raise a dispute and track its status on the OneScore app as well.

So, having different credit scores across different platforms and bureaus is perfectly normal and as long as your score is more than 750, you’re good to go! You will get good credit product offers - loans with lower interest rates and credit cards with higher limits!

But whatever your score, do ensure you make it a habit to check your Credit Score often to see if any of your credit products/an incorrect entry is affecting it without you knowing. Checking your credit score does not affect your credit score. One the contrary it will help you understand and improve/maintain your score better. Read: 5 reasons to check your credit report regularly

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

Low credit score or no credit score? Get a secured credit card!

- OneScore , December 09, 2021