Will a secured credit card really improve my credit score?

It takes time to build or improve a credit score, but a secured credit card can help you get there faster!

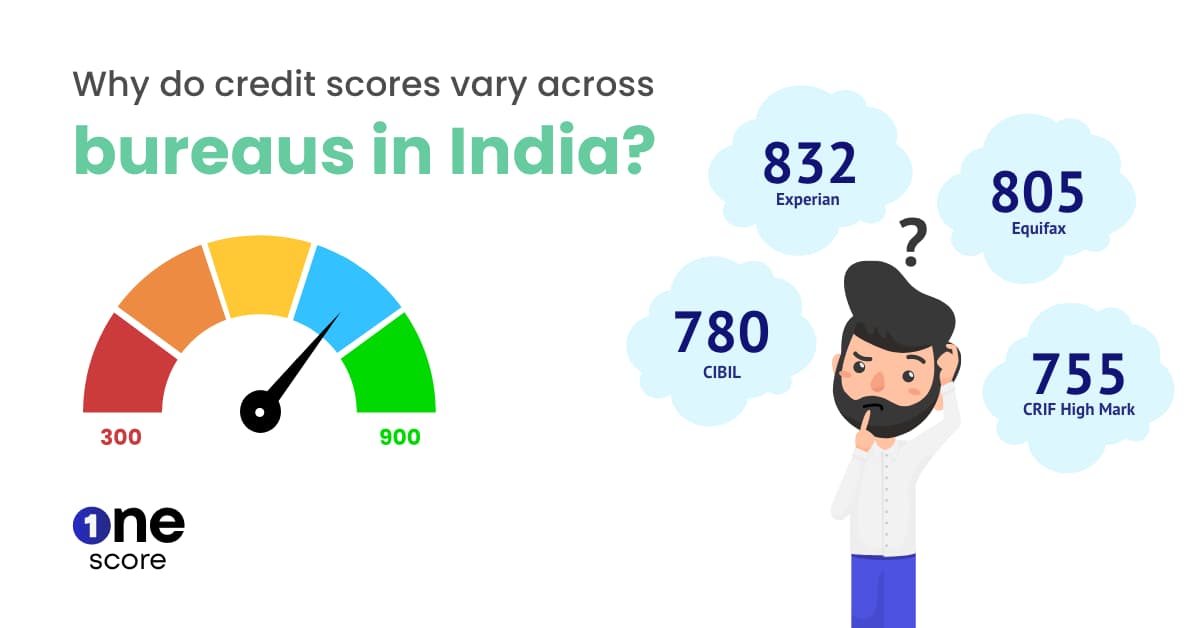

Credit score is a three digit number which shows to the lenders how likely you are to pay back borrowed money. In other words, credit score determines your creditworthiness as a borrower. Your credit score can range anywhere between 300 - 900, and anything above the score of 720 is considered as a good credit score.

Credit score is an important factor in your financial life as it determines various factors for you. It also serves as a benchmark for lenders to determine whether they should give you a loan or not. And the rule of thumb is simple - the higher your score the higher your chances of getting a loan (with a lower interest rate) and/or credit card (with higher credit limit).

How does one figure out what their score is and whether it is high or low?

Here is where the app OneScore comes to your rescue. This is a no-spam app which allows you to check your score in a very simple way, as many times as you want in the month and at zero cost! Once you have figured out your score and its current position (high/low), it provides you with pro tips to boost your credit score, gives you a route to dispute your score if you disagree and an easy way to instantly start improving your score by getting secured credit card (which is an assured card for you even if you have a low credit score today) and just using it to make your purchases!

What is a secured credit card?

A secured credit card is one that is issued against a collateral, which is usually a Fixed Deposit (FD) with the bank that is issuing the card. Since the element of risk is covered, the approval is also often quicker compared to an unsecured credit card. Your credit limit for a secured card will be a certain percentage of the FD amount, subject to the issuer.

Once you get the secured card explore it and then follow these tips given below to ensure that your score is improving as you use the card!

Make as many purchases as possible using your secured credit card

To make your secured credit card get recorded by the bureau to improve/build your credit score, the first thing is to use your card regularly. So whether it is a big purchase or your everyday spends to order food, travel etc. - remember to use your secured credit card.

Ensure you don’t use 100% of your credit limit

While you should use your card to make maximum payments, do not spend 100% of your credit limit. If you spend 100% then Banks see you as a “credit hungry” customer and will be careful in the future if you ever apply for a loan or another credit card.

As mentioned above, the credit limit of your secured card depends on the amount of the FD you created as a security collateral for the card. The higher the FD amount, the higher your credit limit. So another thing you can do if you have an idea of your monthly spending levels is then make sure the limit of your secured card is higher than that, i.e. open an FD with a higher amount.

Pay your credit card bills regularly

At the time of applying for a loan, lenders are extremely interested in how reliable you are in paying your bills and they make their decision based on your past performance. The logic is simple: if your history shows you have a tendency to pay bills on time, the chances of you paying your future dues on time are higher.

Hence, when you pay your secured card bills in time, your credit score will improve.

In case in a particular month you are unable to pay your entire credit card bill, make sure to pay at least the minimum amount due (5% of the credit bill) so that your credit score is safeguarded and not negatively affected.

Conclusion

Building or improving your credit score takes time, and there are no shortcuts for it. However, a secured credit card is the easiest way to speed up the process of building your credit score and taking it high!

The coolest and fastest way to improve your credit score is by getting a One Credit Card.

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

Low credit score or no credit score? Get a secured credit card!

- OneScore , June 29, 2021