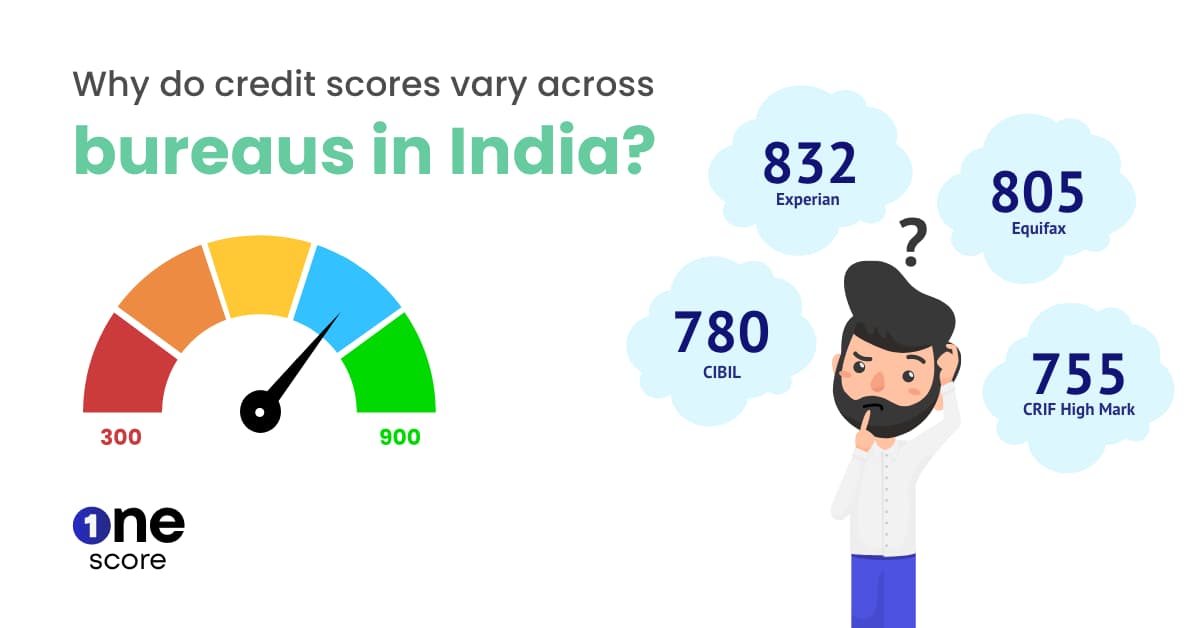

Why do credit scores vary across credit bureaus?

With four credit bureaus in India, it is not surprising that credit scores vary across credit bureaus. Here's a quick guide to help you understand why that happens.

For many Indians, credit scores and credit reports are still a relatively new concept, even though they’ve been around for over a decade. As the number of individuals applying for loans and credit cards has increased, so has the awareness and importance of building a credit score and its importance in determining eligibility criteria for a credit product.

Number of credit bureaus in India

Currently there are 4 credit bureaus in India for retail consumers. Set up around 2000, CIBIL is the oldest, with Experian, Equifax and CRIF High Mark receiving their licences around 2010. The CIBIL Score was established in 2007 and made available to consumers from 2011. Each bureau has their own credit score for a consumer for the same/similar data and financial information.

Free credit reports

Did you know you can get 4 free credit reports in a calendar year? Back in September 2016, the RBI had mandated that each credit bureau has to provide one FREE credit report per calendar year to each consumer, which means you can get four free credit reports in a calendar year along with your credit score at that time.

Different credit score from different credit bureaus

One of the most common assumptions is that your credit score is the same everywhere. This does not happen because each bureau has their proprietary algorithm and scoring model, so it is perfectly fine to have different credit scores from different credit bureaus. A couple of reasons why this happens:

Information sharing between lenders and bureaus

Credit bureaus get their information from banks and financial institutions. It is possible that some data may not be provided to all bureaus at the same time, as lenders have their own schedule of reporting credit information to each bureau.

This can result in one bureau having more unique data points or up-to-date information than the others, affecting the overall credit score due to the weightage given to that ranking factor.

Inconsistencies in reporting information to credit bureau

Credit scores across credit bureaus can vary in the 50-100 point range. However, if you notice a very significant difference higher than this range, it could be due to an incorrectly reported or wrongly captured data point. Such errors can be brought to the notice of the bureau as well as the financial institution so they can verify and make the necessary corrections.

Another reason for inconsistencies could be due to different contact information provided when applying for a loan or credit card, most commonly seen with joint applications with siblings, parents or spouse. This can cause fragmentation and inconsistency in the data points available across different bureaus, for eg, if the primary applicant is your parent or spouse, but the email id and/or phone number belongs to you.

Which credit score is the best?

There is no “best” credit score. While all these four credit bureaus provide a credit score in the 300-900 range, each of them will assign a credit score as per their own algorithm. This means you can have four different credit scores from four credit bureaus, and all these four credit scores would be valid.

What you should focus on instead is checking your credit report regularly from each bureau for errors/inconsistencies, and report them.

Which credit score should you follow?

A credit score is a measure of the risk factor involved in lending to you - in other words, your creditworthiness. Typically, if you have a good score in one bureau, it is quite likely to be good in other bureaus as well, so you can choose to follow or track your credit score from any bureau.

On the other side, banks and financial institutions have different criteria to disburse loans or approve credit card applications. They may choose to refer to a credit score from any one or more of these credit bureaus. For eg, if you are applying for a credit card from a bank, they may fetch your CIBIL credit score and credit report. If you are applying for a loan/line of credit from a lending app, it may fetch your Experian credit score and credit report.

If you’re applying for One Credit Card from the OneScore app, it will fetch both your CIBIL and Experian credit score to generate an offer for you.

To recap, these are the common reasons why your credit score varies across credit bureaus:

1. Scores with bureaus are from different dates or time periods

2. Scores are calculated by using different algorithms and models

3. Lenders may report information to the bureau differently across time intervals

4. All bureaus may not have information linked to a particular email id or phone number

In the OneScore app, you can get your CIBIL and Experian credit score and credit report every month, for free.

Remember: Fetching your own credit score does not affect it.

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

- OneScore , February 15, 2021