What Is CIBIL Score and What Are the Factors Affecting It?

CIBIL score is a 3-digit number on your credit report ranging between 300 and 900 that shows your creditworthiness. Read on to know more!

What is CIBIL Score and Its Importance

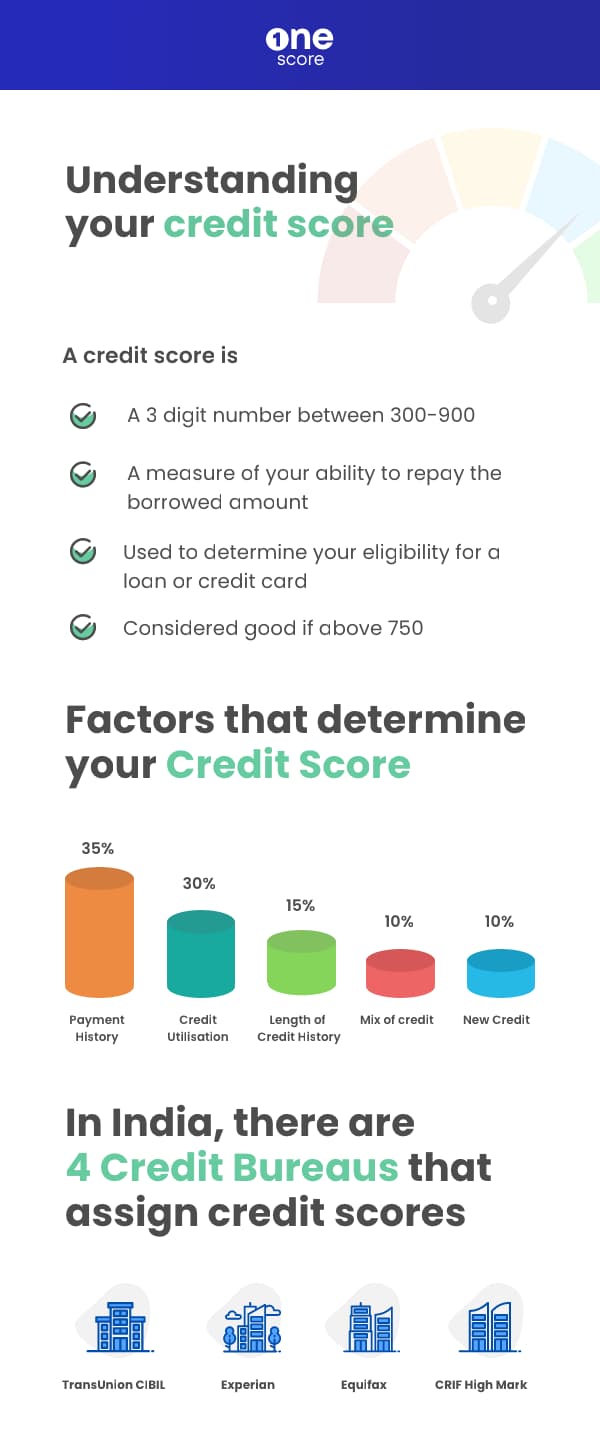

A Credit Score is a 3 digit number calculated by a Credit Information Company (CIC), or credit bureau, which summarises your credit history.

This credit score is a measure of your creditworthiness as an individual, or your ability to repay a borrowed amount towards a loan, a line of credit, or a credit card. It ranges between 300 to 900, and a score of 750 or above is considered good, although this varies across bureaus.

The bureau uses information provided by your bank about past repayment history, to predict the risk of you not repaying a future loan. A person with a history of timely repayment will have a higher credit score compared to an individual who has missed loan EMI payments or credit card dues.

In India, there are 4 RBI-approved Credit Information Companies or credit bureaus:

a) TransUnion CIBIL

b) Experian

c) Equifax

d) CRIF High Mark

How is CIBIL Score Calculated?

Now that you know what is CIBIL score, let us understand how it is calculated.

Step1 : Go to OneScore app

Step2 : On the homepage, you will see your CIBIL & Experian Score

Step3 : Click on the CIBIL Score to see your credit history and understand the factors influencing your credit score

Step4 : You can click on any of the factors to know the details

In the OneScore app, you can check your CIBIL and Experian credit report and credit score for FREE.

CIBIL Score Range

If you are wondering what is credit score and want to check if you have an ideal credit score, check out your credit score on OneScore. Compare it with the below-mentioned ranges to know where you stand.

- 750-900: Excellent CIBIL Score

- 650-750: Fair CIBIL Score

- 550-650: Average CIBIL Score

- 300-500: Poor CIBIL Score

Why Your CIBIL Score Matters?

Your CIBIL score is an important criterion when it comes to loan applications. A good CIBIL score is the direct indicator of your credit worth, which determines your ability to borrow in the future.

- Whenever you apply for a loan or credit card, the lender checks your CIBIL score before approving the loan application.

- The higher your credit score, the lower the interest rate you get on your loan.

- A lower credit score may also lead to the lender rejecting your loan application.

- Individuals with high credit scores also stand the chance of getting approved for higher loan amounts as the chances of default are less.

- People with a high credit score have an upper hand while negotiating for the tenure of the loan.

5 Factors Affecting Your Cibil Score

When calculating your credit score, each bureau uses multiple data points along with their own algorithm and scoring model. However, these 5 factors are commonly used by bureaus to determine your credit score. Each of them carries its own weightage and importance, although the exact percentage for each factor may vary across bureaus.

1. Payment history

Payment history is the most important factor when calculating the credit score, and lenders look at this when determining your eligibility for additional credit - whether a loan or credit card.

Even a single missed or delayed payment can cause your credit score to drop, besides giving an indication that you could do so again in the future. Always make loan and credit card payments on time to avoid a negative impact.

Payment history usually accounts for 35% of your credit score.

2. Credit Utilization Ratio

The credit utilization ratio is an indicator of the credit limit used up by you, and is calculated by simply dividing your credit usage by your overall credit limit.

To a prospective lender, this shows how “credit-hungry” you are and also indicates you could be living beyond your means. You should ideally avoid using more than 30% of your available limit at any time and always make payments in full whenever possible.

Credit utilisation accounts for 30% of your credit score.

3. Length of Credit History

This is an indicator of how long you have been using a credit product, and the longer, the better. The bureau considers age of the oldest and newest accounts and the average age of all your accounts.

For lenders, a long credit history shows your ability to manage credit for longer periods, so don’t be in a hurry to get rid of your oldest credit card just yet.

The length of your credit history accounts for 15% of your credit score.

4. Credit Mix

It is good to have a “mix” of credit as it shows your ability to manage different types of credit products. Some common types would be: Home Loan, Vehicle Loan, Education Loan, or even a Line of Credit - which are instalment based (EMIs), and credit cards, which are billed upon usage.

Lenders consider these accounts when evaluating your application for new credit and how you are managing them, so a home loan would carry more weight and indicates higher stability than a personal loan or credit card.

Credit mix makes up 10% of your credit score.

5. New Credit

Each time you apply for a new personal loan or a credit card, a “hard inquiry” (or a hard pull) is done by the lending institution, and this is shown on your credit report. Too many new applications or new accounts may cause lenders to feel you are facing issues with managing your cash flows and financial obligations, and may lead to rejection of a fresh application.

A “soft inquiry” on the other hand, is when you check your own credit score or if a bank wishes to increase your credit limit or determine your eligibility for a credit product (without your applying for it).

New credit accounts make up 10% of your credit score.

FAQ

1. What Is a Good CIBIL Score?

A CIBIL score of 700 & above is generally considered good. To maintain a good credit score, you have to ensure timely payments, avoid hard inquiries, and maintain a healthy credit utilization ratio.

2. What Is Meant by CIBIL Score?

The Credit Information Bureau (India) Limited (CIBIL) is the most popular credit information company licensed by the Reserve Bank of India. It records individuals’ credit history and determines their credit scores.

3. How Is CIBIL Score Calculated?

CIBIL Score is calculated based on important factors such as Payment history, Credit Utilization ratio, Credit Age, Inquiries, etc. You should track your CIBIL score from time to time to build creditworthiness.

4. What Is CIBIL in Simple Words?

CIBIL is a credit rating agency that determines your creditworthiness, which determines your lending power in the future. It collects the required data from banks and lending institutions to assess your credit history.

5. What If CIBIL Score Is High?

Additional Read:- What is a marriage loan?

The higher your CIBIL Score the better. It can get you faster approvals on your loan applications, lower interest rates, and more negotiation power.

In the OneScore app, you can get your FREE CIBIL and Experian credit score and credit report along with detailed information on these factors as well as tips to improve your credit score.

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

- OneScore , January 16, 2020