Credit score changed? 'Find Out Why'!

Ever wondered why your credit score has changed? This latest feature in the OneScore app helps you find out.

Meet Mira.

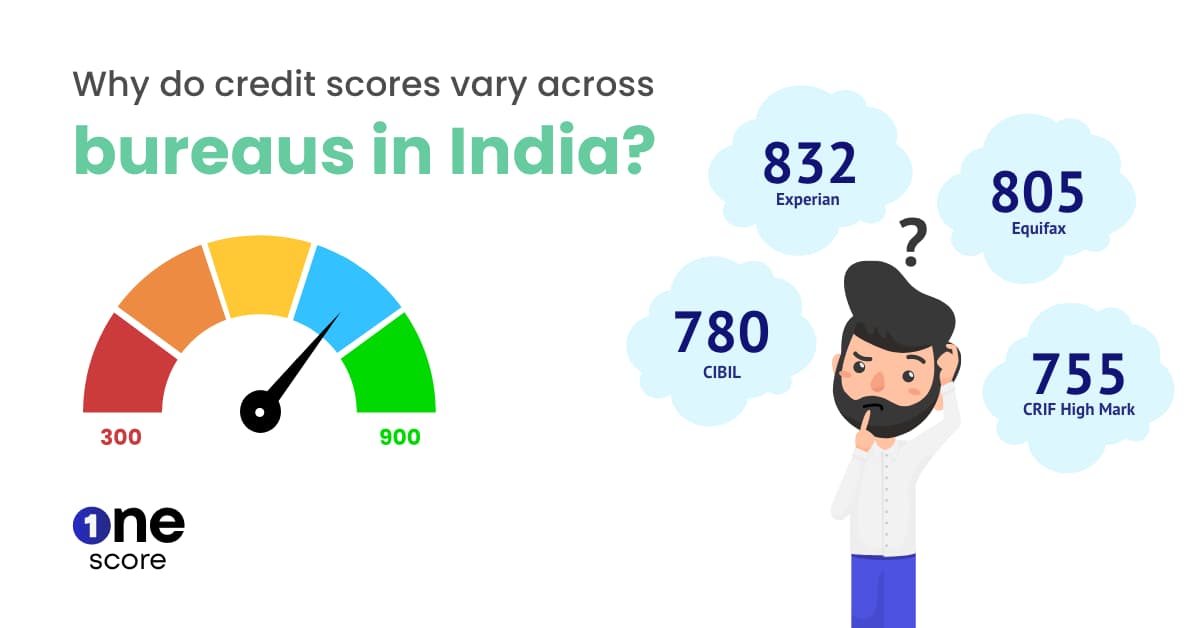

She checks her credit score regularly and, each time, notices a change in her score. Sometimes it goes up, and sometimes it decreases in spite of her paying her credit card bills on time. Every time she wonders why it changes but cannot figure it out. She has searched on the internet, and while there is a lot of generic information available, she hasn’t found any way to find out the exact reasons why ‘her’ score keeps moving up and down.

Have you ever felt the same way? No Sweat. We hear you!

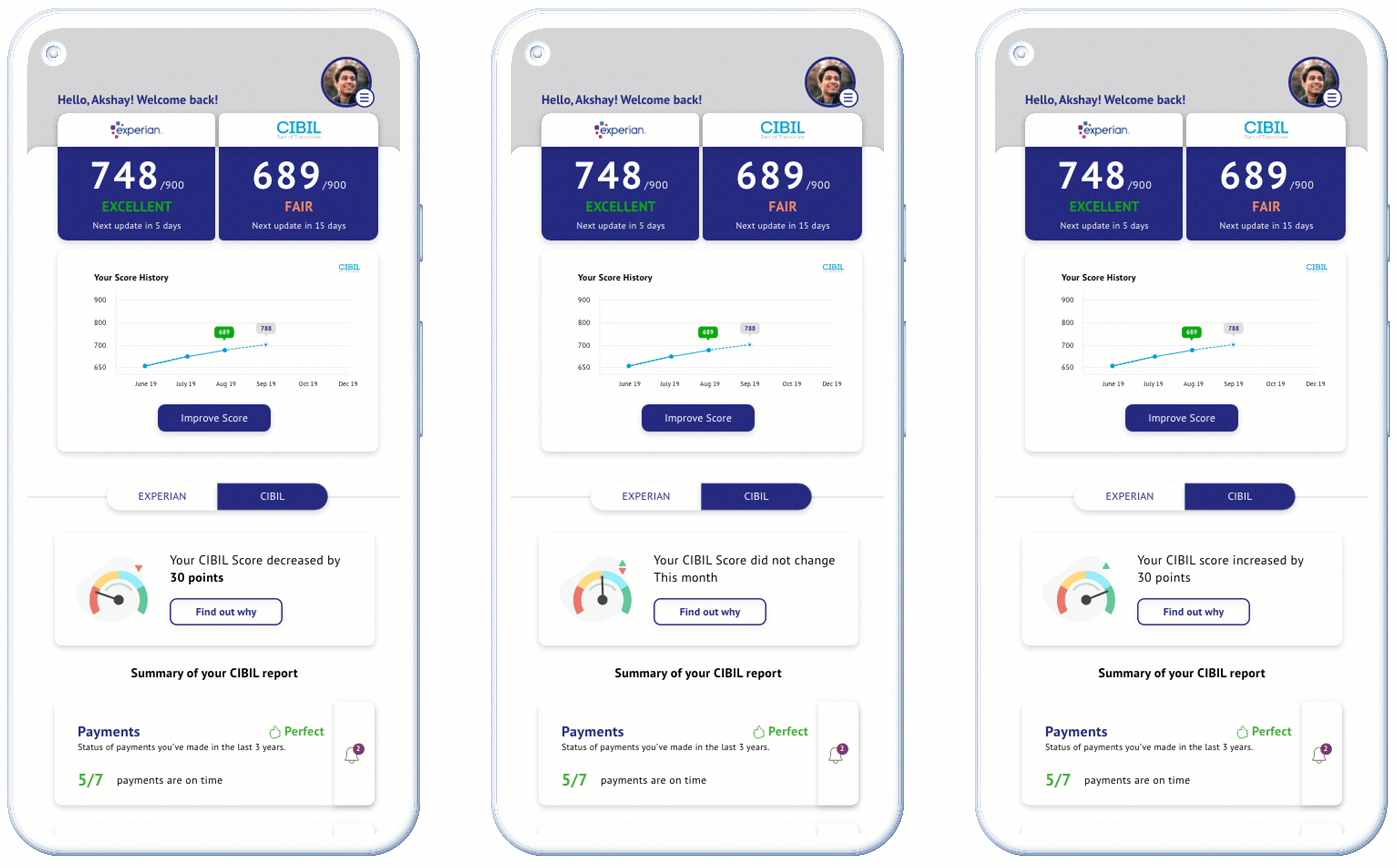

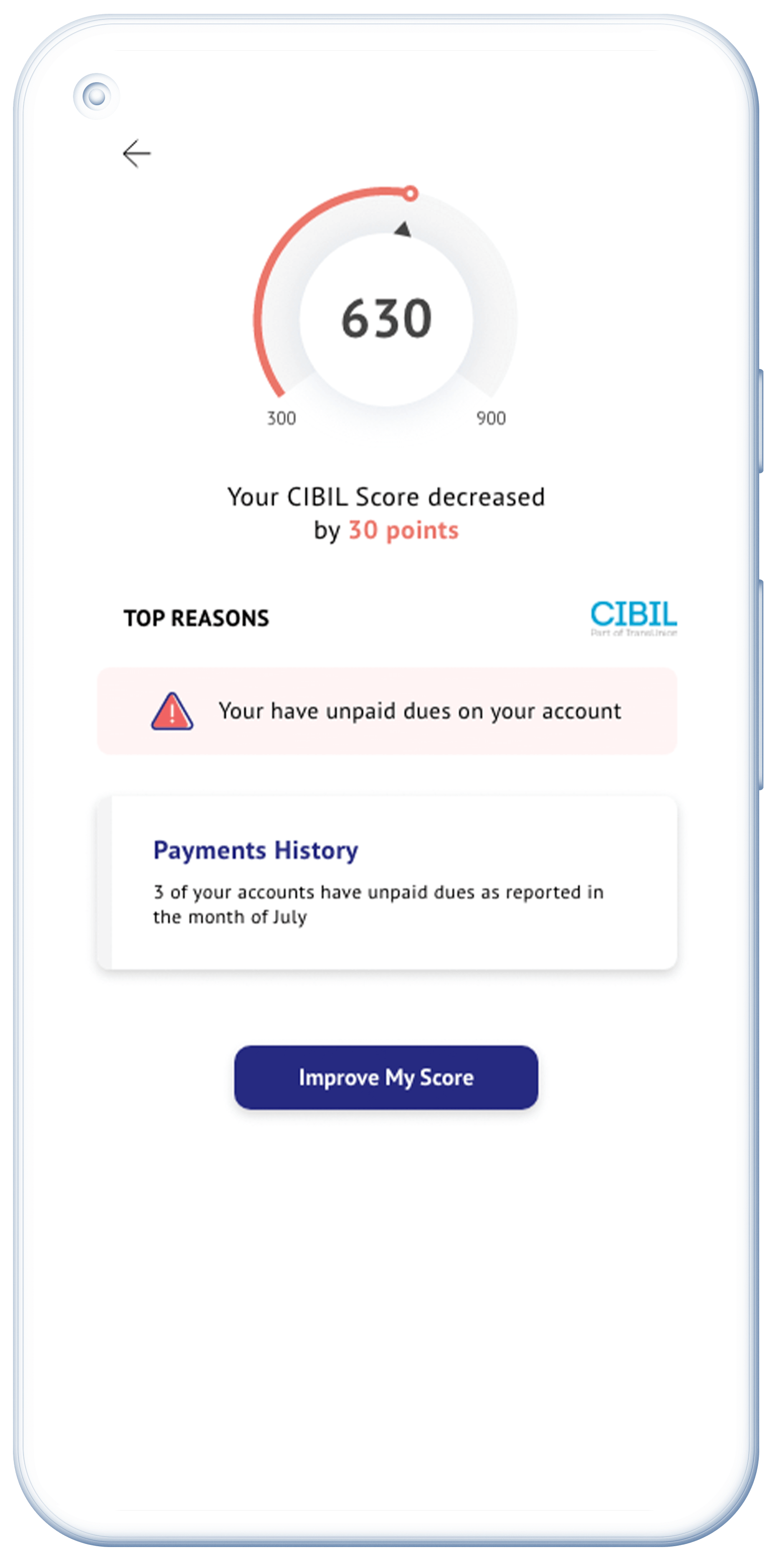

Our latest innovation in the world of the OneScore app is - Find Out Why?

As the name suggests, this new feature analyses your data and tells you all the reasons why your credit score has changed. All this in a matter of seconds! So, the next time you want to find out why your score is changing, remember all you have to do is open the OneScore app and click on Find Out Why!

Why is it important to ‘Find Out Why’ your score is changing?

It’s possible that in a particular month, your score increased without you having done anything differently. On the contrary, you may be consciously trying to increase your credit score and making several changes to improve your credit score. In another month, your score dropped because you didn’t pay your bill on time. Or maybe, it dropped because you used your credit card way too much. There could be multiple such situations you come across.

Whatever the movement, it is important for you to check your credit score regularly and understand why the score is changing. Once you understand the reasons behind an increase/decrease in your score, you will be empowered to continue with good financial habits and change the not-so-good ones so that your score remains healthy.

Get a hang of what you are doing right and what you need to corr

For example, “why did my score change even after paying all the dues?” is the first question that comes to anyone’s mind. And, it’s valid too! After all, payment history makes up for 35% of your credit score. Here’s where the “Find Out Why” feature will help you to identify other factors like overusing your credit limit etc., which can also be reasons for a change in your score. So this feature also helps you identify what you need to change/do to start improving your credit score.

Also read: Factors which affect your credit score!

So wait no more! If you don’t have the OneScore app, get it today to check your score & understand why it changed last month!

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

- OneScore , December 04, 2021