CIBIL Dispute Resolution - Tips For CIBIL Report Correction

To report a fake loan, login to 'myCIBIL' option, then click on 'Credit Reports' and select ‘Dispute Center.’ Fill in the details of the desired dispute item.

In the last few weeks, many well-known celebrities discovered fake loans in their name and all hell broke loose in the media! There were articles and blogs all over which explained how, why this could happen, which put pressure on the financial entity to proactively take ownership and resolve the issue.

But what if it were not a celebrity? What happens if this happens to you or any of your friends/family? What are you supposed to do then? Where do you go and complain? Better still, how are you supposed to ensure this doesn’t happen again?

Fortunately, there is a solution - and in fact, it’s not that complex either! The only way to ensure this doesn’t happen to you is by tracking your credit payment history regularly and making sure no incorrect entry has made its way into your credit report.

5 Tips To Identify Credit/Loan Fraud

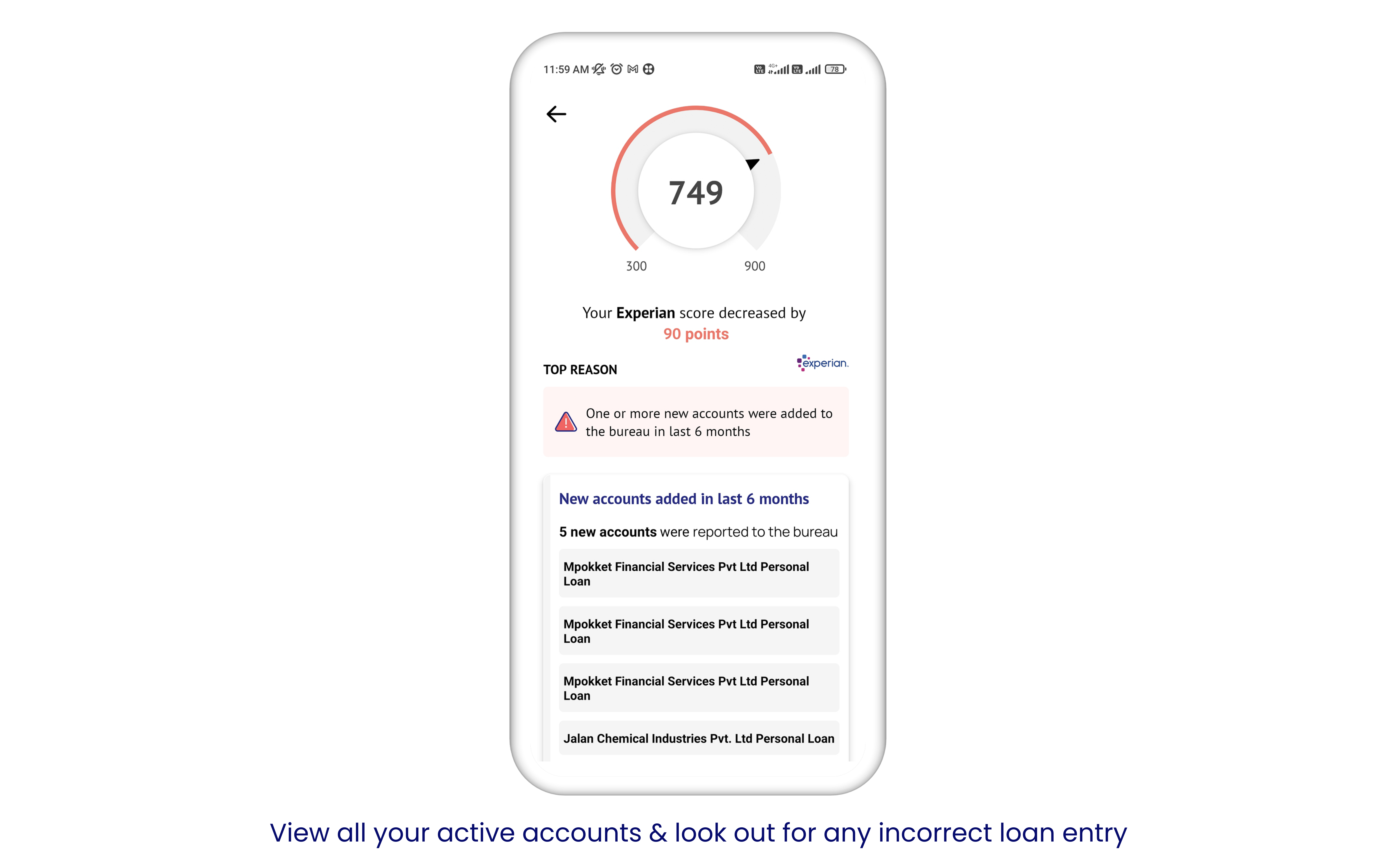

Check Your Credit Report Regularly

This holds true even if you have been paying perfectly on time. The more regularly you track it, the quicker you will notice a drop in score or a new erroneous/fake entry in your payment history.

You can use any platform for regular credit score checks; however, most will charge you after 1-2 pulls of the credit report. OneScore is a super simple app that lets you check and improve your CIBIL score for free.

Click here to see all your active/closed account details in a single dashboard.

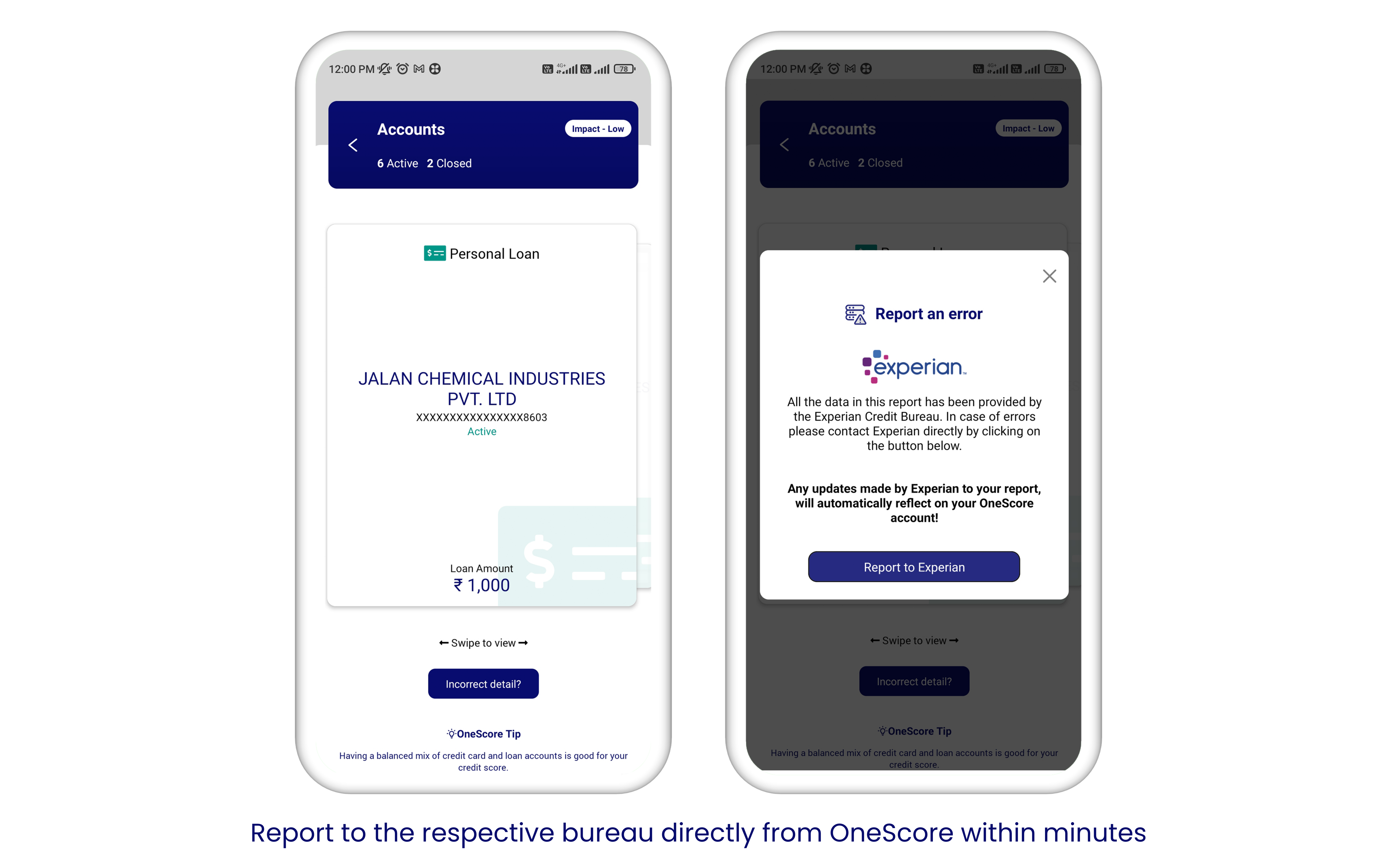

Raise a Dispute If You See Any Wrong Entry

As you are aware, there are many bureaus in our country, but for the purpose of this blog, let’s assume that the score drop or the fake/erroneous entry is related to your Experian score. You have two options - directly go to the Experian website or open/download the OneScore app and simply follow the process to report a wrong entry.

Follow Up On Your Raised Dispute

Your job doesn’t end after reporting, unfortunately. The resolution can take weeks to months as they will first need to check the genuinity of the claim. One done, you will get notified that your dispute has been resolved and the incorrect loan has been removed from your report.

Be proud of being an informed, financially educated, smart customer who checks their credit score and credit report regularly and tells others to, too! #scoredekhakya

Make Sure To Check The Wrong Entries In Your Credit Report Regularly

Genuine or fake - all loans are listed in your credit report. Even fraudsters don’t have a way to manipulate your report to their benefit. So download OneScore today and make it a habit to check your credit report month on month- and ensure your financial life is right on track.

Additional Read: Why Should You Check Your Credit Report Regularly?

How to Raise a CIBIL Dispute for Credit Report Correction?

- Check your credit report on CIBIL’s website or OneScore.

- Review it for errors or discrepancies.

- Collect supporting documents.

- Login to CIBIL. Submit a dispute form with accurate details and attach supporting documents.

- Follow up with CIBIL for updates.

- CIBIL will investigate and update your report if any errors are found.

FAQs

-

How can I dispute my cibil score? To raise a dispute on CIBIL , login to ‘myCIBIL’ option, then click on ‘Credit Reports’ and select ‘Dispute Center.’ Fill in the details of the desired dispute item.

-

Can the bank rectify the cibil score? Banks themselves cannot rectify or change your credit score directly. You need to raise a dispute with the credit information company.

-

How can I remove the negative impact on my CIBIL score? Check your credit report thoroughly to identify any errors or discrepancies. Raise a dispute with the credit bureau and keep any supporting documents, such as payment receipts, loan closure letters, handy.

-

How can I remove CIBIL written off status? Discuss the possibility of settling the debt with the lender. Offer to make a lump sum payment or propose a structured repayment plan that is feasible for you. Once you have reached a settlement agreement with the lender, make the agreed-upon payment promptly. After making the full payment, request a No Due Certificate or a closure letter from the lender. And if the “written off” status was reported in error, you can raise a dispute with the credit information company.

-

How to check CIBIL dispute status? You can check the status by logging into CIBIL under the ‘Dispute Status’ section. Additionally, CIBIL also notifies you about the status of your dispute via email.

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

6 sure-shot steps to a Winning Credit Score this Financial Year

Common errors in credit report that you should look out for in 2022

- OneScore , April 04, 2022