Use the Score planner to increase your credit worth in 2023

OneScore’s score planner helps improve your creditworthiness and increases your chances of getting loans or credit cards. Read more to know how to get started.

Listen to the article here:

The new year brings with it a lot of expectations to do better. Be it your goals, lifestyle, or just improving prospects for the future, it requires you to maintain a healthy state of finances.

And one of the major aspects of personal finance is credit management.

Let’s be realistic. Not all your goals can be achieved with savings. You will need financing at one point or another which requires you to be creditworthy.

How is creditworthiness defined in India?

There are the top four credit bureaus that define credit score in India:Equifax, Experian, CIBIL™ & CRIF™. Your credit score can be anywhere between 300 to 900, depending on how well and how long you have used credit. A Credit score of 750 is considered good and can get you the best terms and offers on loans or credit cards.

Factors affecting credit score

1. Payment history (accounts for 35% of your credit score)

It’s crucial to pay your dues on time and in full. Delayed or missed payments can bring down your score drastically.

2. Credit utilization ratio (accounts for 30% of your credit score)

It’s important to maintain a healthy credit utilization ratio so you don’t appear credit-hungry to prospective lenders.

3. Credit length (accounts for 15%)

The longer your history of timely payments, the better your credit score. That’s why the age of your credit also plays a role in defining your credit score.

4. Credit mix (accounts for 10%)

Having a good credit mix is basically having different forms of credit and handling them well.

5. New Credit (accounts for 10%)

Whenever you apply for a new line of credit, which can be a credit card, car loan, etc, a hard inquiry is done on your account. This sometimes causes a temporary decline in credit score.

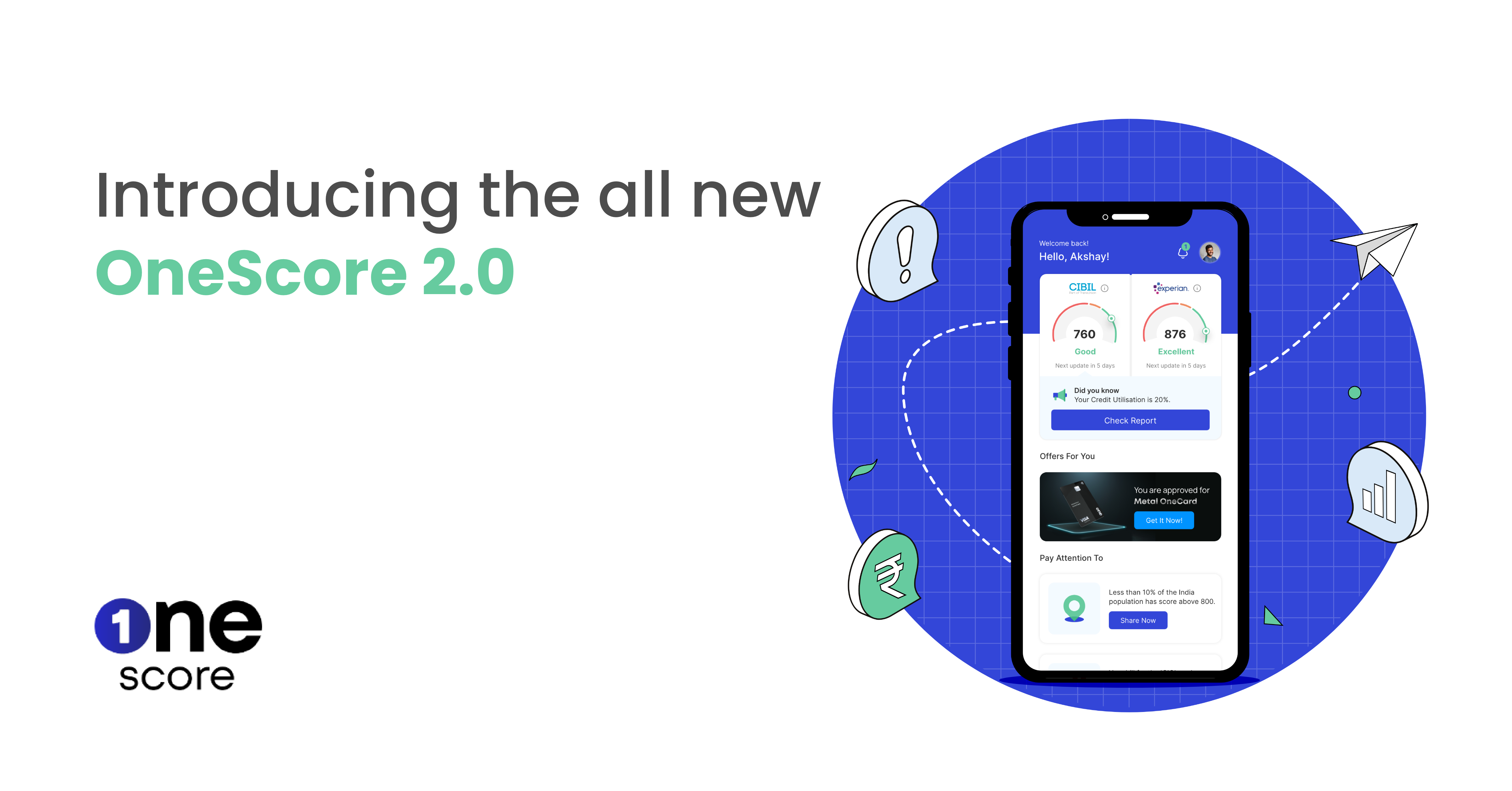

How to use the OneScore Scoreplanner to up your credit score

Keeping tabs on all factors affecting your credit score may not always be possible, but it is important. Thankfully, with OneScore’s Scoreplanner it’s a breeze.

Here’s how to plan the perfect score in 2023:

2 . Open the Score planner

3 . Put your ideal score

4 . Mention by when you want to achieve it

And voila! You will get personalized tips to achieve your score target. Ensure you follow these tips while using credit and see your score grow.

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

Things to remember while paying your premiums with a credit card

- OneScore , January 23, 2023