How to Calculate EMI for Your Personal Loan

Learn how to choose the best personal loan. Calculate your EMI before choosing a personal loan.

Personal Loan is one of the most accessible credit products that provides quick financial support in times of need. With a 100% online application procedure, swift disbursals, and no collateral requirements, borrowing a Personal Loan is a smart way to acquire instant cash for planned and unplanned expenses. Once you avail of a loan, you must clear it through Equated Monthly installments (EMIs), the fixed monthly payments equally divided as per the months of repayment. To choose the best loan offer and determine an appropriate loan term, you must calculate the EMI for Personal Loan before borrowing. Wondering how to calculate Personal Loan EMIs for your loan plan? Here is everything you need to know.

Understanding the Components of Personal Loan EMI Calculator

Your Personal Loan EMI depends on several factors, including your affordability, repayment capacity, and DTI ratio. A Personal Loan EMI calculator takes into account the following components, based on which lenders calculate EMI for Personal Loan:

1.Principal Loan Amount:

The amount you borrow from the lender is a crucial factor in determining the monthly EMI. The higher the principal amount, the higher the EMI value.

2.Interest Rate:

A lower interest rate leads to a lower EMI value. Looking for a lender offering the lowest interest rate is crucial.

3.Repayment Term:

Tenure is the duration across which you must clear the loan. EMI is inversely proportional to the repayment term. Dividing the loan cost into more EMIs increases the total interest outgo and makes the loan costlier. The best way to get a Personal Loan and repay it efficiently is to choose a loan plan with the shortest possible repayment term.

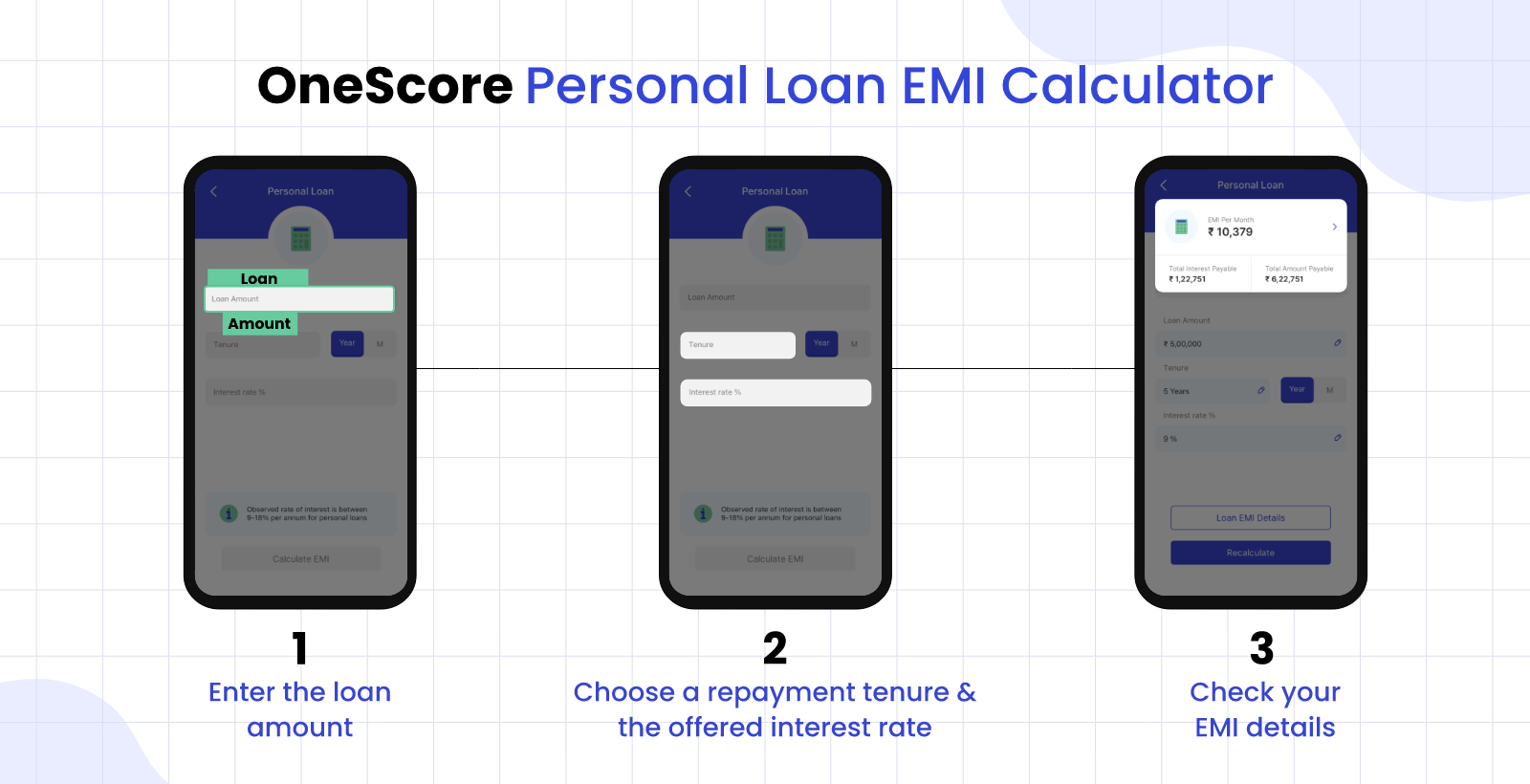

How to Calculate Personal Loan EMI Using Calculator

The best way to calculate the EMI on a personal loan is to use an online personal loan EMI calculator. You have to follow these simple steps to do that:

- Enter the loan amount

- Select the offered interest rate

- Choose a repayment tenure

Once you enter these values into each category, the EMI calculator will provide the results almost instantly, including the exact EMI amount, total interest cost, and total loan cost. If the EMIs are beyond your budget, you can opt for a longer loan term to reduce the EMI amount and make them more manageable.

How to Calculate Personal Loan EMIs Manually

You can also calculate Personal Loan EMI manually using this mathematical formula:

P × r × (1 + r)n/((1 + r)n – 1).

In this formula, you must enter the principal loan amount for P, the interest rate for r, and the number of months in the loan tenure for n.

Doing this math can be time-consuming. For faster and error-free results, calculate your EMIs on OneScore

Factors Affecting Personal Loan EMI

Personal Loan EMIs are Equated Monthly installments that borrowers must pay to the lender each month to pay off the loan. Each EMI consists of both the interest and principal amounts, and most loan providers offer flexible repayment terms that you can choose from as per your monthly affordability. Crucial factors affecting the EMI for a Personal Loan include:

- Principal Loan Amount

- Interest Rate

- Repayment Tenure

Your affordability, repayment capacity, financial obligations, etc., also affect your choice of loan tenure, which eventually affects your Personal Loan EMI.

Additional Read: How to Improve Your Credit Score

Tips to Manage Your Personal Loan EMI Payments

Now that you are aware of the variables and factors affecting EMIs, it is important to consider these tips to manage EMI payments:

- Decide on an Appropriate Loan Amount:

Deciding on an adequate loan amount is the most important step, as it directly affects the payable EMI amount. The aim is to strike a balance between the principal amount and the loan requirement. A Personal Loan eligibility calculator helps calculate an appropriate loan amount according to your needs and repayment capacity. You must consider your income, future growth potential, and current financial obligations while making this decision.

- Choose a Trusted Loan Provider:

You may get different interest rates from various loan providers. Carefully choose a trusted provider by comparing their loan amounts, interest rates, processing charges, repayment terms, customer service, and other parameters. A lender offering the lowest interest rate and flexible repayment terms is worth considering. You may also look for lenders offering personal loans without income proof.

- Select an Appropriate Loan Tenure:

Longer loan tenures reduce your EMI amount but increase your loan duration and interest outgo. In such a case, the loan becomes more expensive to borrow. The trick is to carefully find a balance between the number of EMIs and the EMI amount. This way, you can even get a Personal Loan without a bank statement.

Once you learn how to calculate EMI on Personal Loan, simply use the required variables to find the EMI that best suits your budget. You can check your credit score online for free and get the best loan plan according to your requirement and repayment capacity.

Frequently Asked Questions

- What Is a Personal Loan Amortization Schedule?

Amortisation schedule is the schedule of loan repayment that contains the plan to repay the EMIs with principal amount and interest.

- How Is the Personal Loan EMI to Be Paid?

As a borrower, you must pay the Personal Loan EMIs one each month during the repayment tenure you select. Each EMI consists of the principal and interest amount that you repay gradually during the loan term.

- Can I Pay EMI in One Attempt?

No, paying EMIs at once is not possible. The lender divides the loan cost into EMIs. You must pay one EMI each month throughout the loan tenure to pay off the loan gradually.

- What Happens If You Fail to Pay Your EMI?

The lender imposes late payment charges and additional interest rates if you fail to pay your EMIs. Subsequent missed EMIs attract legal action against the borrower.

- How Is EMI Deducted from a Debit Card?

You can activate the e-mandate to schedule automatic EMI repayment through your debit card. If you do that, the EMI gets deducted from your bank account each month automatically, saving you from manually paying the EMIs.

- What Are the Benefits of Knowing Your EMI in Advance?

Knowing the EMIs in advance helps plan the repayment better, as you know how much you must keep aside and budget your expenses to pay the EMIs.

To stay informed on all things credit management and personal finance, check out OneScore

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

- OneScore , September 04, 2023