How is your CIBIL Score calculated?

The CIBIL score is a 3-digit number between 300 and 900 that indicates your credit repayment capacity. The closer it is to 900, the better your chances of getting approved for a loan or credit card. In fact, it is the most important parameter that lending institutions consider while reviewing your loan application. It helps lenders determine your eligibility, loan amount, and interest rate.

Who decides your credit score?

TransUnion CIBIL is the oldest credit bureau that collects details regarding your borrowing pattern and repayment behavior to calculate your CIBIL score. In addition to CIBIL (Credit Information Bureau (India) Limited), there are three other major credit bureaus in India that collect and maintain credit information: Equifax, Experian, and CRIF High Mark.

How is CIBIL Score Calculated?

TransUnion CIBIL follows the FICO scoring model for CIBIL score calculation. It looks at specific things related to your credit behavior and gives a certain weight to each of them. It sources the information required for calculating the credit score from your financial and banking institutions. The percentage of weightage it assigns to different aspects of your credit patterns is as follows:

- 30% to payment history, which includes your recent payments and whether you made them on time or not

- 25% to credit exposure (the money you owe currently)

- 25% to credit duration and type—secured and unsecured loans you manage at present—and the age of your credit card or loan account

- 20% to other factors, including active credit card and loan accounts and recent credit inquiries

What Are the Factors That Go into the Cibil Score Calculation?

The credit bureau calculates your CIBIL score based on the following factors:

1. Repayment History

Your repayment history is one of the most crucial factors that CIBIL considers while calculating your credit score. Missed EMIs, delayed credit card bill payments, and defaults on your account can severely impact your credit score. Paying your loan EMIs and credit card bills on time and in full will help you maintain a perfect repayment history.

2. Credit Utilisation Ratio

The percentage of your credit limit that you have used is termed the “credit utilization ratio”. It’s important to maintain a low credit utilization ratio to build a healthy CIBIL score. Excessive use of credit makes you appear credit-hungry to potential lenders.

If the lender rejects your applications, your Credit Score will further decrease, making loans less accessible. Even if some lenders agree to approve your loan, they will charge a high interest rate to compensate for the risk they take in lending you money.

3. Credit Mix

The diversity of credit accounts you have in your portfolio is known as the credit mix. You may broadly classify your credit accounts into loans and credit cards. Keeping a healthy mix of credit products is crucial to maintaining a good CIBIL score.

4. Number of Active Credit Accounts

The number of loan and credit card accounts under your name indicates your dependency on credit. If you have multiple active credit lines, it might make future lenders wary about your credit requirements and repayment capacity. It gives the impression that you heavily depend on credit. If you have several high-paying credit card debts at present, consolidating them with a single loan and making timely payments may prove beneficial.

5. Number of Hard Inquiries

Each time you apply for credit, the finance company pulls a hard inquiry from your credit report to assess your creditworthiness. CIBIL records each of these hard inquiries in your CIBIL report. Too many inquiries within a short period indicate credit-hungry behavior and reduce the CIBIL score significantly. The score goes even further if the finance company pulls a hard inquiry and decides to reject your application. Hence, it is always advisable to keep a gap of at least a few months between two credit applications.

What Should Be the Ideal CIBIL Score?

1. What CIBIL Score is Considered Good?

A CIBIL score of 750 and above is considered excellent and increases the chances of borrowers getting credit easily. A high Cibil score also indicates financial discipline and consistent repayment behavior. Any CIBIL score between 550 and 700 indicates irregular credit repayments, with lenders considering you a risky borrower, leading to rejection or high-interest charges.

2. What are the advantages of having a good CIBIL score?

A good cibil score makes it easy for borrowers to have a loan approved at the earliest possible time. Since a borrower’s cibil score is what the lender looks at first, a good score indicates that the borrower is trustworthy and reliable and will make timely payments. The chances of the loan application getting turned down also come down drastically.

Additional Read: 5 Factors Determining Your Credit Score**

How Can You Improve Your CIBIL Score?

There are various ways of improving one’s cibil score. Some of these have been given below:

- Set reminders for payment and be disciplined with credit. Reminders will ensure that you make timely payments and avoid defaulting, resulting in a sustainable credit score over time.

- Maintain older credit cards to lengthen your credit history. It pays to maintain older credit cards, as they help maintain a solid credit history.

- Customize your credit limit. Limit your credit usage. Avoid reaching the limit on their credit card, as it may lower your credit score.

- Avoid taking on too much debt at once. Ensure the number of loans taken during a period is minimal. Repay your existing loan in full before taking the next one.

Following these tips over a period of time helps increase cibil score and maintain a healthy score over time. These play a part in one’s cibil score calculation, and borrowers who feel their score has improved can download a cibil score calculator for free online and see their new score.

Frequently Asked Questions

- How much is a 700 CIBIL score?

700 is a good CIBIL score that indicates a consistent repayment history, responsible credit behavior, and low financial obligations. It’s a good credit score to obtain most funding options.

- What is a good CIBIL score?

A CIBIL score above 700 is good enough to obtain most loans. It represents a good credit history with responsible credit handling in the past.

- What is the CIBIL score 1 to 5?

The CIBIL score ranges from 300 to 900. It should be above 700 to obtain the most funding options. So, there is no CIBIL score from 1 to 5.

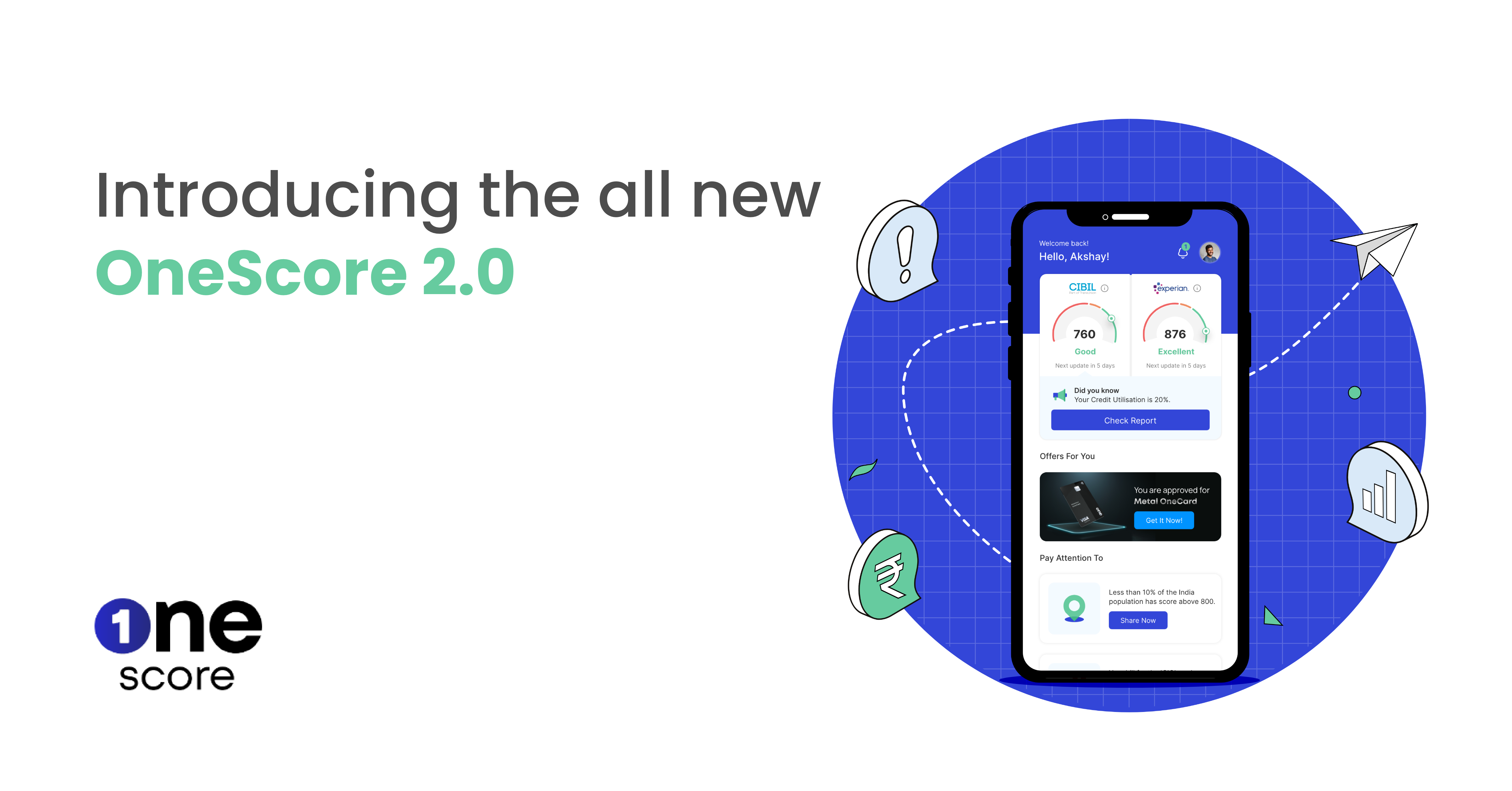

- How can I check my CIBIL score online at no cost?

Checking your CIBIL score online is easy. You can visit the CIBIL official website and follow these steps to check your credit score. Visit the CIBIL official website

- Click on ‘Get Your Credit Score’

- Fill in details like your PAN and identity proof

- Proceed to Payment

- Choose a plan and make the payment

or you can also check it out for free on OneScore.

- Will a loan rejection affect my CIBIL score?

Yes. If a lending institution rejects your loan application, it will negatively affect your CIBIL score. Each loan query pulls a hard inquiry on the credit report, which reduces the credit score by a few points. Loan rejection further affects your credit score and decreases your probability of getting a loan in the future.

To check your credit score for free and stay informed on all things credit management, Download OneScore

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. FPL Consumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

How to Report an Error on your Credit Report: A Step-by-Step Guide

Things to remember while paying your premiums with a credit card

- OneScore , July 17, 2023