Understanding the OneCard Rewards Programme

Your guide to OneCard Rewards - reward rate, how to redeem points - all this and more.

Simplicity, Transparency, and Giving Full Control to our users are the building blocks of OneCard’s mission to re-imagine credit cards in India.

Keeping these in mind, we have recently upgraded your OneRewards, enhancing the experience to make it Faster, Simpler and Fun to use - while standing true to our promise of giving you full control of your OneRewards from the app. In other words, we made your OneRewards simply #OneDerful!

What makes OneRewards #OneDerful?

Our entire team wrapped their heads around making the OneReward experience truly rewarding. From design to interface to using your reward points, every element of rewards was focused on making it something like never before.

We gave our OneRewards section a makeover, ensuring that we cover everything you would require to know about your reward points. So whether it is using your points or tracking your rewards activity, or collecting and flaunting your stamps, we’ve covered it all.

In addition, you can track and understand your 5X and keep a tab on your bonus points activity - We have made sure we’ve redefined it all for you. And if you think we’ve still missed out on anything, we would be glad to hear about it from you.

Benefits of OneRewards - Why OneRewards?🎁

Points Are Issued Instantly

No more waiting to know your latest points balance.

So far, we have been used to seeing reward points credited several days after making a purchase, either by logging into the bank’s website or in the monthly statement, and we wanted to change that experience for you. We wanted to bring to you an experience where you will be able to immediately see how many points you have received if you make a purchase.

With OneCard, your reward points are issued instantly, and they get displayed in the OneCard app. For every Rs. 50 spent, you get 1 reward point.

Reward Points On All Spends *

No need for multiple credit cards, just One is enough 😉

Most credit cards have now discontinued offering points on utility payments, fuel, and insurance. All three are essential categories, and considering that each household spends a substantial amount on these, getting rewarded for these is nothing but fair!

We reward you EVERYWHERE! That’s right - your OneCard earns points on all categories of spends, including fuel, insurance and utility payments, without any restrictions on amounts.

* Points are not credited on cash withdrawals, transfers, and wallet loads.

5X On Top 2 Categories

Rewards were never this “Rewarding!”

Many of us tend to use 2 or more credit cards, mostly to maximise rewards or cashback across individual categories, so X Bank card for air miles, Y Bank card for shopping, Z Bank card for dining - ugh! isn’t that frustrating? But that’s how we’ve trained ourselves to maximise our reward points - but what if we told you - no more of this hassle!

It’s time to unlearn these old ways because your OneCard gives you a chance to maximise your rewards 5X, i.e., 5 times on your Top 2 categories each month. In a mood to splurge on entertainment in June? We’ve got you covered. Fancy a shopping spree in July? Planning a trip to your favourite destination but need endless pre-bookings? Go ahead and claim your 5X rewards on it.

To be eligible for this, you need to spend on at least 3 categories in a month from which the Top 2 categories will be eligible for 5X. The category selection is completely transparent as we’re using standard VISA merchant categories.

Fractional Points

Say goodbye to rounding off and losing points - get rewarded for every rupee you spend!

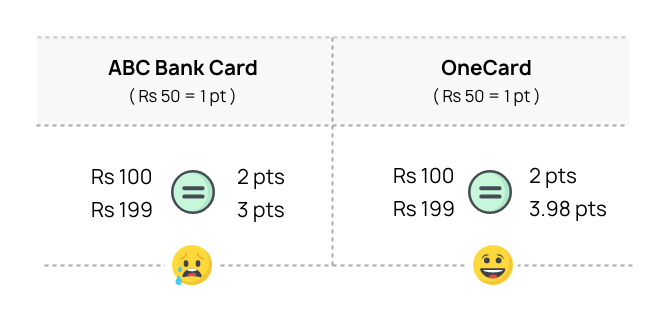

Usually, when you spend on your existing credit cards, the reward points are credited after rounding off the amount as per the decided rate.

We strongly believe that when you use your OneCard, you deserve to get your money’s worth regardless of the transaction amount, so even a quick recharge of Rs. 25 will earn 0.5 points (which is usually 0 points with other banks), and a spend of Rs. 199 will earn 3.98 points (usually 3 points with other banks).

Unlimited Points That Never Expire

Imagine saving up your reward points for many months because you want to redeem them for a specific item or gift, only to see that some of those points have expired. We know this can get frustrating - months and months of saving all gone to waste. Not only do you feel betrayed, but there’s a sense of loss as well.

When you get reward points on your OneCard spends, they come with lifetime validity. Also, there’s no maximum number of reward points that you can earn in one go. So, you can keep earning and collecting your reward points without the worry of them expiring.

You’ve earned those reward points, you get to keep them.

Slick In-App Points Redemption

Typically, the process of redeeming or using your reward points is tedious, and the struggle is real! Be it using a bank’s website, calling their call centre, or sending multiple SMSes and emails, the process in most cases still remains unclear and boring.

At OneCard we’ve eliminated the need for all this along with any unnecessary redemption charges, and have brought to you the smart way of using and managing your OneRewards.

We decided to stick to the basics, focusing on making the process simple, fast and convenient.

On collecting sufficient points, you can use your points either to repay existing transactions or use them as cash which will get adjusted against your outstanding OneCard bill.

You need a minimum of 100 reward points to redeem or use against any transaction or get it as cash. For e.g., if you use 100 reward points, either Rs. 10 will be deducted from your OneCard bill or you can use it against a transaction of the same amount, i.e. Rs. 10.

Here’s how you can use your OneReward Points:

- Go to your OneRewards section

- Click/Tap on Use Points

- Swipe from right to left to choose from a transaction/ cash credit that you want to use your points for

- Long press on the desired transaction/ cash credit bubble

- Pull down the selected transaction/ cash credit bubble to use your reward points.

Zero Rewards Redemption Fee

Most banks levy a rewards redemption fee when you wish to redeem or use your reward points. This fee is usually around Rs. 150 or so.

We wanted to keep redemption completely stress-free, and we also believe you shouldn’t have to pay for redeeming points that you’ve earned by making purchases. After all, they are your hard-earned points! Hence, we made sure that there is no redemption fee to redeem your reward points on your OneCard.

Redeem as many points as you want, as often as you want, for free!

Keeping things simple and completely transparent, you can also track all your reward related activity - from your stamp collection to credit reward points to upcoming points and even the ones you’ve used in your OneRewards section.

Even as we continue to add more benefits to the OneCard Rewards Programme along with the roll-out of other features, our biggest learnings come from you, the user, so please keep the feedback coming and help us enhance your OneCard experience!

**Disclaimer: The information provided on this webpage does not, and is not intended to, constitute any kind of advice; instead, all the information available here is for general informational purposes only. Oneconsumer Services Private Limited and the author shall not be responsible for any direct/indirect/damages/loss incurred by the reader in making any decision based on the contents and information. Please consult your advisor before making any decision.

- OneScore , June 12, 2020